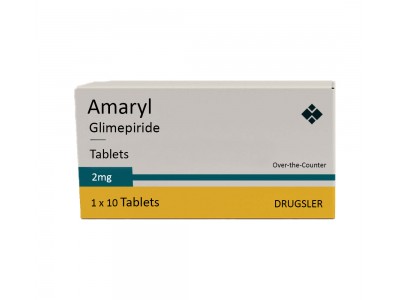

The cost of Amaryl (glimepiride) without insurance can vary based on several factors. People with diabetes often rely on this medication to manage their blood sugar levels. However, for those who do not have insurance coverage, understanding the cost of Amaryl without insurance is essential for budgeting and planning. Below, we will explore the average cost and various ways you can potentially reduce the expense of buying Amaryl.

What Affects the Cost of Amaryl Without Insurance?

Several factors influence the Amaryl price without insurance, including where you purchase the medication, the pharmacy's pricing policy, and the dosage you need. Some pharmacies may offer discounts or loyalty programs, while others may charge higher rates for the same medication.

Understanding the Average Cost of Amaryl

Typically, the average cost of Amaryl without insurance can range from $20 to $150 for a 30-day supply, depending on the dosage (e.g., 1 mg, 2 mg, or 4 mg). It’s crucial to shop around and check with multiple pharmacies to find the best price. For those seeking a monthly supply, the glimepiride cost without insurance can be a significant concern, especially for those with limited financial resources.

How Much is Amaryl Without Insurance?

If you're wondering how much is Amaryl without insurance, it's important to note that the cost can vary widely. Generic versions of the drug, such as glimepiride price without insurance, are often less expensive than branded options. However, even generic versions may cost different amounts at different locations. The price could also change based on whether you choose a local pharmacy or an online pharmacy for delivery.

Cost of Amaryl Medication Without Insurance

For those who don’t have insurance, the Amaryl medication cost without insurance is a valid concern. In addition to the standard price, some people opt for discount cards or coupons to reduce the overall cost. In many cases, these tools can provide savings of up to 50% off the retail price. It’s always wise to inquire about available savings programs when filling a prescription for Amaryl.

Options for Reducing the Price of Amaryl

One way to lower the cost of your monthly prescription is by exploring options like mail-order pharmacies, where you might find better deals. Another strategy is to look for Amaryl cost per month without insurance plans offered by local health clinics. Some charitable organizations or pharmaceutical assistance programs might also help you offset the costs of your prescription. Furthermore, buying in bulk or purchasing a higher dosage pill and cutting it in half could save money in the long run.

Buying Amaryl Without Insurance

When considering buying Amaryl without insurance, it’s important to compare the prices offered by different sources. Many pharmacies have varying rates for the same medication, so it’s worth doing some research to find the best deal. Additionally, check with your healthcare provider to ensure you are getting the correct dosage and a reputable pharmacy for the most cost-effective option.

Conclusion: Managing the Cost of Glimepiride

The glimepiride monthly cost without insurance can be significant, but there are ways to reduce the financial burden. By exploring discounts, using generic versions, and comparing prices from various pharmacies, you can find ways to make your medication more affordable. Always consult with your doctor to discuss alternatives or savings programs that may help you manage the cost of Amaryl.