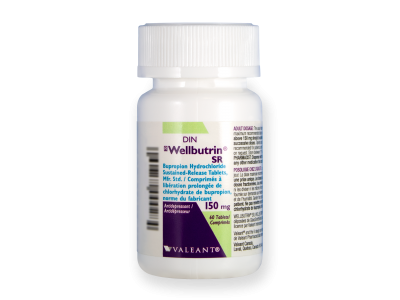

Insurance coverage for Wellbutrin, also known as Bupropion, can vary depending on your specific insurance plan. Many health insurance plans do offer coverage for prescription medications like Wellbutrin, which is commonly prescribed for depression and smoking cessation. However, the extent of coverage and the associated costs can differ significantly from one plan to another.

When exploring the possibility of insurance coverage for Wellbutrin, it’s essential to review your policy carefully. Contact your insurance provider or consult your insurance documentation to understand the specifics of your coverage. This includes determining whether Wellbutrin is included in your plan’s formulary, which is the list of drugs that your insurance covers. Also you can buy Wellbutrin (Bupropion) on czech pharmacy.

Insurance plans typically involve co-pays, deductibles, and co-insurance. Co-pays are fixed amounts you pay for each prescription, while deductibles are the initial out-of-pocket expenses you need to cover before your insurance coverage kicks in. Co-insurance is the percentage of the medication cost you’re responsible for after meeting your deductible. These factors can affect how much you pay for Wellbutrin.

If Wellbutrin is not covered under your insurance plan or if you face high out-of-pocket expenses, you may consider discussing alternative medications with your healthcare provider. They can recommend alternative treatments that are covered by your insurance and may be equally effective for your condition.

In some cases, your healthcare provider can also help by submitting a prior authorization request to your insurance company, explaining the medical necessity of Wellbutrin. This can sometimes lead to coverage approval, even if the medication isn’t initially included in your plan’s formulary.

Ultimately, while many insurance plans do offer some level of coverage for Wellbutrin, the specifics can vary, and it’s crucial to be well-informed about your policy’s terms and conditions to manage the costs effectively.